The Social Security System (SSS) will implement a landmark Pension Reform Program starting September 2025, in line with the directive of President Ferdinand R. Marcos Jr. and following the discussion of Finance Secretary Ralph G. Recto with the President on the matter. Supported by comprehensive actuarial studies, the program features a structured, three-year increase in pensions for all SSS pensioners – the first multi-year adjustment of its kind in the institution’s 68-year history.

The SSS Pension Reform Program was approved by the Social Security Commission (SSC) under Resolution No. 340-s.2025 dated 11 July 2025. Corresponding SSS Circular on the Program shall be published accordingly in a newspaper of general circulation.

Anchored on Republic Act No. 11199 (Social Security Act of 2018), particularly Section 4 empowering the SSC to adjust pension benefits, this reform answers the long-standing call for higher pensions while ensuring the fund’s long-term stability.

“We’ve heard the clamor for higher pensions loud and clear,” said SSS President and CEO Robert Joseph M. De Claro. “With the guidance of Finance Secretary and SSC Chairperson Ralph G. Recto, and after careful actuarial review, we are rolling out a rational and sustainable pension increase that uplifts all pensioners without compromising the fund’s actuarial soundness.”

Pension Increases from 2025 to 2027

The increases will be implemented in three annual tranches every September:

-

September 2025 (for pensioners as of 31 August 2025):

-

10% increase – Retirement and Disability Pensioners

-

5% increase – Death or Survivor Pensioners

-

-

September 2026 (for pensioners as of 31 August 2026):

-

Additional 10% increase – Retirement and Disability Pensioners

-

Additional 5% increase – Death or Survivor Pensioners

-

-

September 2027 (for pensioners as of 31 August 2027):

-

Additional 10% increase – Retirement and Disability Pensioners

-

Additional 5% increase – Death or Survivor Pensioners

-

After three years, pensions will have increased by approximately 33% for retirement/disability pensioners and 16% for death/survivor pensioners.

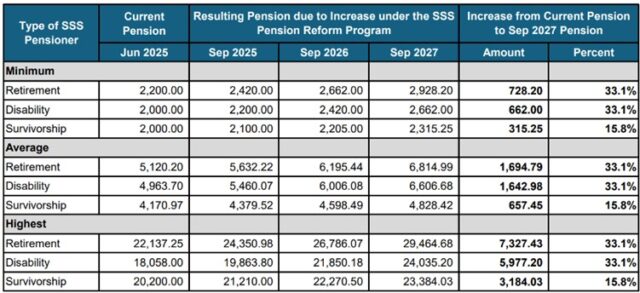

Sample Pension Increases (2025-2027)

The table below illustrates the estimated pension increases for sample cases over the three-year implementation period (2025–2027).

Reform Principles

The program is guided by three principles:

-

Uplifting all pensioners through inclusive benefit adjustments.

-

Recovering from inflation to protect purchasing power.

-

Promoting the value of working, saving, investing, and prospering, as mandated by RA 11199.

Impact and Financial Sustainability

According to the SSS Chief Actuary, the reform will result in only a manageable reduction of fund life from 2053 to 2049, offset by stronger cash flows from previous contribution reforms and enhanced collection efforts.

“Our actuarial team confirms that the fund remains financially sound,” De Claro stressed. “We are committed to restoring fund life back to 2053 through coverage expansion and improved collection efficiency.”

The reform will benefit over 3.8 million pensioners, including 2.6 million retirement/disability pensioners and 1.2 million survivor pensioners, and is projected to inject ₱92.8 billion into the economy from 2025 to 2027.

No Contribution Increase

This Pension Reform Program (PRP) will not necessitate any contribution increase unlike the ₱1,000 additional benefit allowance given to all pensioners starting 2017 that immediately required contribution increases to restore financial stability to the SSS fund.

The SSS Pension Reform Program of 2025 marks a historic step toward a more inclusive and responsive social security system—one that protects the dignity and well-being of Filipino retirees and their families.