Social Security System (SSS) President and CEO Michael G. Regino today reminded delinquent employers that the deadline for application for its Pandemic Relief and Restructuring Program 2 (PRRP 2), a social security contribution penalty condonation program for business and household employers, will be on May 19, 2022.

“We encourage qualified employers to avail of the PRRP 2 early so that they can avoid the inconveniences of last-minute filing and face the risk of missing the opportunity,” Regino said. “This will not only enable delinquent employers to regain their good standing with the SSS but will also prevent the further accrual of penalties on their past-due social security contributions. It will also help their employees avail benefits and loans,” he added.

The PRRP 2, launched last November 19, 2021, covers past-due social security contributions for the months of March 2020 to the present time.

Regino said those qualified to avail of the program are employers who are delinquent in the payment of their contributions for the said period and whose financial positions demonstrate a clear inability to pay their assessed delinquency charges due to economic crisis, serious business losses or financial reverses, natural calamity or man-made disaster without fault on their part.

“By availing of the program, the employers will be able to settle their delinquencies for the said period through one of two payment methods, both with the condonation of accrued penalties,” Regino added.

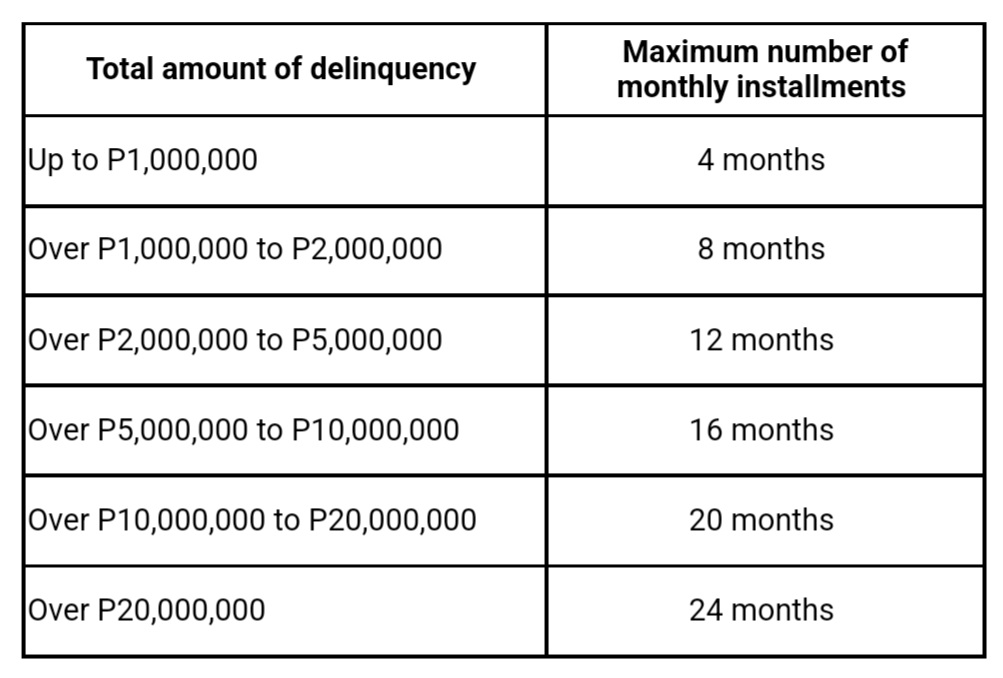

The first payment method is through the full payment of the total assessed contribution delinquency within 15 calendar days from the receipt of Notice of Approval by the SSS, while the second is through installment payments for a period of four to 24 months, depending on the employer’s total amount of delinquency.

The schedule of monthly installment payments is as follows:

A down payment of at least five percent of the amount of principal delinquency is required under the installment payment method. It also has an interest rate of six percent per annum.

To apply for the PRRP 2, employers must submit an Application Form, together with the proposed mode of payment and supporting documents, to the SSS branch or the Large Accounts Department (LAD), whichever has jurisdiction over their account.

Employers may refer to this link for the complete list of required documents https://bit.ly/SSSCI2021-015.

Employees’ Compensation (EC) contributions and penalties are not covered under the PRRP2, however, the payment of EC contributions and penalties is also a requirement for application to the program.

Pending cases or final judgment of employers involving the collection of contributions and/or penalties incurred from the applicable month of March 2020 and onwards may be withdrawn upon the approval of their PRRP 2 application, without prejudice to its revival or refiling. Those with judgments that have acquired finality, however, are no longer covered by the program.

If an employer has a pending or approved proposal under the Installment Payment Scheme Program, or pending application under the program for acceptance of properties offered through Dacion en Pago but decides to apply for the PRRP 2, his/her application to the former two will be considered withdrawn or canceled upon the approval of his/her application to the latter.

Meanwhile, employers who are subject to the Warrants of Distraint, Levy, and/or Garnishment (WDLG) processes and procedures for delinquencies incurred for the month of March 2020 to the present may still avail of the PRRP 2, except where a WDLG has already been issued.

Under Republic Act No. 11199 or the Social Security Act of 2018, if an employer fails to pay contributions to the SSS as prescribed, it will incur a penalty of two percent per month from the date the contribution falls due until paid.