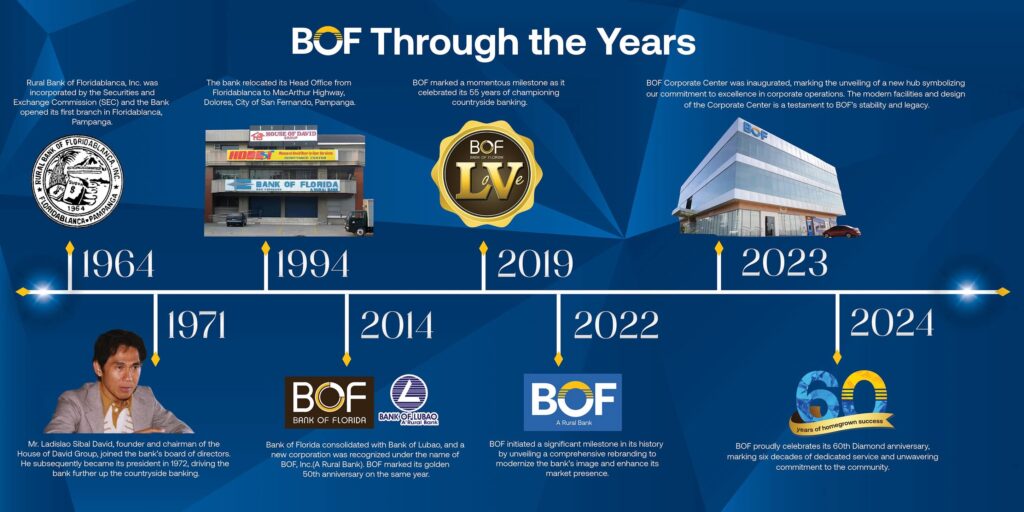

AT 60+, the go-to bank of micro, small, and medium enterprises is a continuing story, aye, a saga since its founding in 1964 as the Rural Bank of Floridablanca, persisting in its rebranding in 2022 as BOF A Rural Bank, in constant definition of its very reason for being – the development of rural communities, fostering countryside progress through inclusive banking services.

Inclusive, as in providing financial access to underserved sectors, from small businesses to farmer and transport groups.

“We build homegrown success through collective growth with our clients and stakeholders…” So, it is written in the BOF’s vision and mission statement.

So, it is accomplished in the testimonials of the bank’s clientele.

“BOF is like salt, they’ve helped us turn our ideas into delicious realities.” So attests Chef Cherry P. Tan, proprietor of authentic Kapampangan restaurant Apag Marangle, now a prized gustatory destination in Pampanga.

“Iba sa BOF. BOF looks after all their clients even if they’re small business owners.” So avers Gheric Manaloto, chief operating officer of RMM Cold Storage & Meatshop, now a leading exporter and distributor of top-notch meat products in Central Luzon.

Homegrown bank channeling community savings to fund homegrown industries empowering local entrepreneurs, engendering rural development. This, in close engagement with regulators as the Bangko Sentral ng Pilipinas and the Securities and Exchange Commission and other stakeholders among government agencies, NGOs, and interest groups.

Committed to supporting initiatives that drive progress and modernization in the countryside, the BOF Eco-Move Loan Program was established in support of the government’s Public Utility Vehicle Modernization Program. Through its availment, the Betis Operators & Drivers Transport Cooperative three brand-new modern PUVs, followed by the Arayat Express Jeepney Transport Service Cooperative with four, for starters.

Rural banking as “an exercise in financial inclusion,” gets flexed in BOF’s myriad interactions with different sectors. Principal of these were the Stakeholders’ Engagement Forum for Start-Up Businesses in the City of San Fernando; Seminar on Wealth Succession Planning and Tax Management; and the EmpowerEd Financial Literacy Project in collaboration with the BSP extended to business and finance students in a series of fora at the City College of San Fernando, Pampanga State Agricultural University, Mary the Queen College, and the City College of Angeles.

BOF is likewise into collaboration and knowledge-sharing within the rural banking community, as exemplified in its On-Site Learning Program at its corporate center for the Rural Bank of Solano (Nueva Vizcaya) and partnerships with the Bicol Federation of Rural Banks and the Rural Bankers Association of the Philippines (RBAP), affirming BOF’s leading role in industry-wide capacity building. In 2023, RBAP recognized BOF as a Pioneer On-Site Learning Bank for Corporate

Governance and Succession Planning and MSME Lending.

BOF’s strong engagement with the BSP in hosting the Know Your Money seminar on the first Philippine Polymer Banknote Series BSP and in the BSP Piso Caravan Program aimed at facilitating public access to exchanging unfit and damaged money to ensure only fit currency remains in circulation led to BOF being the first in Central Luzon to have a Currency Exchange Center as part of its regular services in its different branches.

Of its 22 branches, all but two – in Bulacan and Tarlac – are located in Pampanga with its flagship branch, the 22nd, inaugurated in June 3023 along Jose Abad Santos Avenue in the City of San Fernando, the regional and financial capital of Central Luzon.

Like all other businesses, BOF was not spared from the economic doldrums wrought by the Covid-19 pandemic. It’s aftermath however made a totally different story for BOF, best told in its expansion – San Jose, Floridablanca and the flagship branches both in 2023, and renovation – of its branches in Mabalacat City in 2022, and in Lubao, Poblacion-Floridablanca, Sto. Tomas, and Porac Sto. Tomas in 2024.

For the record: As of Dec. 31, 2024, BOF has P5.93 billion in total assets; P990 million in total capital; P4.56 billion in total deposits; and P4.25 billion in total gross loans. BOF ranks among the Top 10 rural banks in Central Luzon and in the Philippines.

Banking on values

“We are here to fill in the gap in the vast banking industry where banks think of their clients first as family. Emphasizing this differentiates us from our competitors; our key demographic can resonate with us better and attest to our genuine and sincere service,” declared then-BOF president and CEO Susan David-Nunga in her 2023 State of the Bank Address themed “Building Homegrown Success” focused on shared growth between the bank, its clients, and its communities.

In his turn at the 2024 SOBA, BOF president and CEO Paolo David Carlos presented the infrastructure of that homegrown success grounded on the very core values of BOF – Competence, Accountability, Responsibility, Integrity, Nurturing, God-driven – CARING for Tomorrow.

That which ensures BOF’s continuing story as a consistent pillar of integrity and innovation in the financial industry in Central Luzon, in the Philippines.