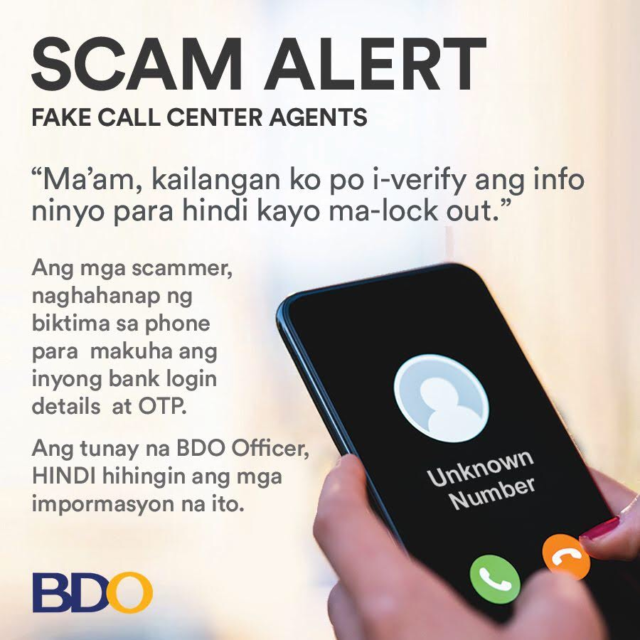

BDO Unibank, Inc. once again warns against scammers who are taking advantage of the enhanced community quarantine to trick people into giving their personal information, such as usernames, passwords, account numbers, and One-Time PINs / One-Time Password(OTPs). Using this information, scammers take their victims’ identities, access their online bank accounts, and steal their hard-earned money.

“Alarmed and anxious, many are victimized, especially those who are new to online banking. We assure our clients that real bank officers will never ask for their personal information. One of the best defenses against scam is never sharing OTPs with anyone,” the Bank said in a statement.

Pretending to be bank officers, they communicate with account holders over the phone, SMS, email, or even social media and urge them to verify their accounts or validate a transaction by sharing their personal information.

Another layer of protection for online bankers

OTPs provide another layer of protection for online bankers. They can be used once and only within a short span of time. The bank sends these unique six-character codes on two occasions: first, to complete a mobile number’s registration to BDO Online Banking, and second, to confirm an online transaction.

Besides asking directly, scammers can obtain OTPs from a stolen phone. They can hack apps, which may have the owner’s banking details to make quick online transactions. The bank reminds its clients to report when their registered mobile devices are stolen or missing, so that it can detect unauthorized transactions from it.

Some scammers select their victims carefully. They gather their victims’ personal information first before attacking. Through a scheme called SIM swapping, they pretend to be the mobile owner and deceive a phone line carrier into giving out a new SIM card.

BDO advises clients, when they notice unusual activities on their mobile devices, to ask their telecommunication company to block their SIM number and for extra safety, freeze their bank accounts through customercare@bdo.com.ph or BDO Customer Care on Messenger.

Keep personal info private

With the community quarantine in place, many Filipinos are shifting to online banking to stay at home and safe from the virus. Through BDO Online Banking, clients can pay bills, send money, load up their prepaid mobile phones, and check account balances.

BDO encourages those who would like to bank online to visit its official website, click on “eBanking,” then “Online Banking,” then “Enroll Now.” An ATM activation code will be sent out via SMS after the application form is completed. This code will allow clients to confirm their enrollment at the nearest BDO ATM.

COVID-19 did not stop scammers from doing what they do best; in fact, it has only fueled them to intensify their attacks. From pretending to be bank officers to staging coronavirus-related schemes, they continue to take a shot at unsuspecting accoun tholders.

BDO however, reiterates that for as long as clients do not share their personal information with anyone, including their OTPs when they bank online, they can beat scam attacks and protect their bank accounts.