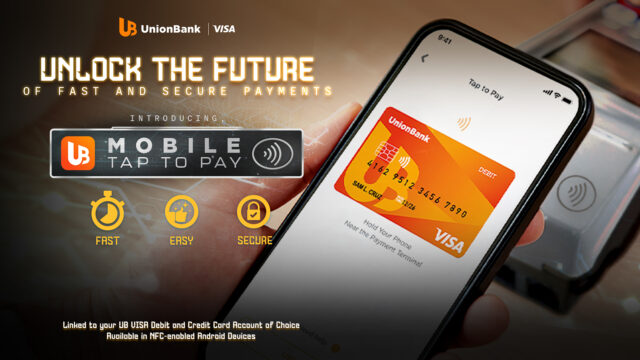

UnionBank proudly introduces the Mobile Tap to Pay feature on its multi-awarded UnionBank Online app—marking a new milestone in digital banking innovation. Designed for speed, simplicity, and security, this latest offering enables users to make everyday payments with just a tap, going truly wallet-free.

Upon activation on the UnionBank Online App, the new feature enables customers to make secure, contactless payments using any NFC-enabled Android device linked to their UnionBank Visa Debit or Credit Card. By simply tapping their phone at any Visa contactless terminal worldwide, users can complete transactions—no physical card needed, no extra steps required.

“With Mobile Tap to Pay, UnionBank is elevating the everyday payment experience for Filipinos. This isn’t just a new feature—it’s a customer-first innovation that brings security, speed, and simplicity of making payments directly via our mobile app. By making digital payments as effortless as a tap without the need to bring out the physical debit or credit card, we’re empowering our customers to move through their day with confidence and ease,” said UnionBank’s Chief Marketing & Experience Officer, Albert Cuadrante.

Once activated, UnionBank’s tap-to-pay feature can be launched directly from the app’s login screen, giving customers access within seconds through biometric authentication. With speed and convenience built into a single tap, the UnionBank Online app allows users to link or unlink their preferred debit or credit card—empowering them to tailor their payment options to their financial lifestyle. But it’s not just about ease of use; it’s about security, too. Each transaction is protected by Visa’s tokenization technology, which replaces sensitive card details with a unique, encrypted code. This ensures critical information remains secure and is never stored or shared with merchants.

This launch marks another milestone in UnionBank’s role as a leader in digital innovation. As one of the first Philippine banks to offer native Mobile Tap to Pay functionality within its app, UnionBank continues to deliver solutions that are not only technically robust, but also intuitive and responsive to the way people live today.

“Whether it’s a quick coffee run, a spontaneous purchase, or a fast-paced commute, Mobile Tap to Pay is designed to keep up with our customers’ lives—making every transaction seamless and stress-free,” Cuadrante concluded.

The new app feature works at millions of Visa contactless payment terminals worldwide, from neighborhood cafés to overseas boutiques, giving customers global convenience with the local reliability they’ve come to expect from UnionBank.

UnionBank’s Mobile Tap to Pay is more than a new way to pay; it’s a step toward more seamless, secure, and future-forward banking experiences.

To get started, update your UnionBank Online app, and setup Tap to Pay. Know more about UnionBank’s Mobile Tap to Pay feature by visiting the UnionBank website at www.unionbankph.com, or follow UnionBank’s official accounts on Facebook, X (formerly Twitter), Instagram, or YouTube for updates. Union Bank of the Philippines is regulated by the Bangko Sentral ng Pilipinas (www.bsp.gov.ph). Deposits are insured by PDIC up to P1 Million per depositor. For more info, please visit our website. For any concern, you may contact us through our UnionBank Online app (Mailbox > Support > Create New Ticket) or our Customer Service Hotline at (+632) 8841-8600.